False self-employment of freelancers

In dit artikel vertellen we alles over de aangescherpte regels rondom schijnzelfstandigheid bij ZZP’ers die per 1 januari 2025 zijn ingegaan.

What is the difference between a holding bv and a regular bv (Dutch Limited Company)? This is a question we often get asked. In this article, we explain the differences and advantages of having a holding bv.

The holding bv is also called the parent company that holds the shares in a subsidiary or operating company, a normal bv. In the normal bv, the company is placed and the day-to-day operations take place.

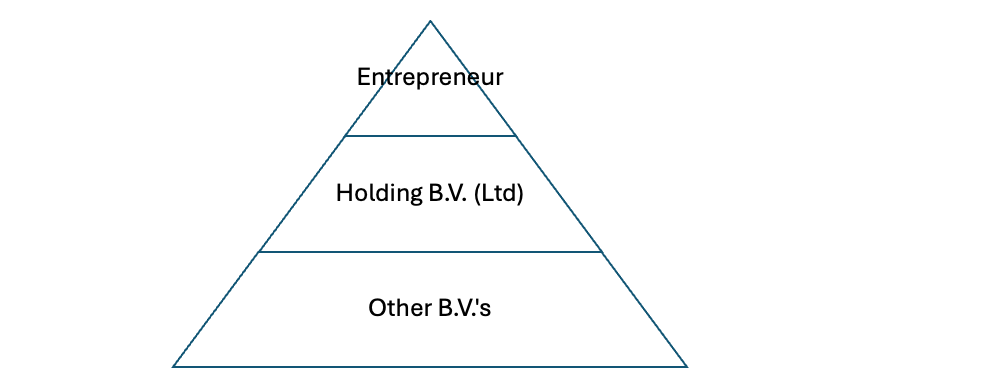

The shares in the holding bv are held privately by the entrepreneur (director-major shareholder) and the holding bv in turn holds the shares in the operating company bv Shown below in a diagram.

At the bottom, the most risk is taken and therefore the companies with related risks are placed in. As higher up the pyramid, the entrepreneur wishes to keep the risk as low as possible. The holding bv houses important assets, builds up pensions and makes investments. The entrepreneur is usually employed by his own Holding B.V. and receives a salary for this (Box 1). Any profits the entrepreneur distributes as dividends (Box 2) or reserves in the holding bv.

The first advantage mentioned above is a limitation of the entrepreneur's private liability. In case of bankruptcy, the operating company in which the company is placed fails and not the entrepreneur so that creditors cannot recover from private assets. Furthermore, there are numerous other benefits to name including:

Do you want to start today?

A bv should be incorporated through a notary public. The deed of incorporation act as the bv's articles of association. If more parties participate (with their own holding bv) in the company (work bv), it is recommended that a shareholders' agreement be concluded. Also, a management agreement will be needed between the holding bv and operating company and an employment agreement between the holding bv and the entrepreneur. Finally, it is advisable to draw up a current account agreement between the various bv’s.

For advice and guidance on setting up a holding structure or converting the sole proprietorship or VOF into a holding structure, please contact us. We will be happy to provide insight into the possibilities and draw up the agreements for you.

In dit artikel vertellen we alles over de aangescherpte regels rondom schijnzelfstandigheid bij ZZP’ers die per 1 januari 2025 zijn ingegaan.

As a sole proprietor in the Netherlands, there are several tax benefits you can make smart use of. You can read more about them in this article.

An audit by the Tax Authorities is something that can happen. However, it does not have to be a stressful experience. In this article, we explain how an audit works and what your rights and obligations are.

In order to provide the best experience, we use technologies such as cookies to store and/or retrieve information on your device. By agreeing to these technologies, we can process data such as browsing behaviour or unique IDs on this site. If you do not give your consent or withdraw your consent, this may adversely affect certain functions and capabilities.