Which is the best choice? Employ a bookkeeper or outsource it to an accounting firm? Read more about it here.

A bv is a legal entity with limited liability. A bv also stands for besloten vennootschap. The designation ‘besloten vennootschap’ means a fixed group of shareholders. Within the bv, the capital is divided into shares. Share ownership is shared by the shareholders, who jointly own 100% of the shares.

The bv is a legal entity and this means that the owner is not personally liable for possible debts of the bv. The main advantage of a bv is that shareholders are protected against financial risks. The maximum amount shareholders can lose in case of bankruptcy is the nominal value of the shares they own in the company. This always leaves a boundary between personal assets and company finances. However, if there is mismanagement, negligence or fraud, owners can be held personally liable.

Setting up a bv is a bit more complicated than a sole proprietorship. To establish a besloten vennootschap several conditions must be met, namely:

Do you want to start today?

A besloten vennootschap (bv) has both advantages and disadvantages. We have listed these for you.

Advantages

Disadvantages

A limited liability company can therefore be an attractive choice. However, there are also disadvantages to this legal form.

The capital of a bv is divided into shares, which are held by shareholders. The supreme power within the bv lies with these shareholders. If you are only a shareholder and not a director, your liability is limited to the amount with which you participate in the company. Annually, the board must prepare financial statements and publish them in time in the Trade Register. The general meeting (of shareholders) must approve the financial statements. Late or incomplete publication may lead to directors' liability.

In 2025, a bv pays corporation tax on profits, divided into two brackets: a lower rate up to €200,000 and a higher rate for profits above that. In addition, a director-major shareholder (dga) must pay himself a regular salary, on which wage tax is levied. Dividend payments may also be subject to substantial interest tax. These tax obligations require careful planning and administration. Read our blog on taxes at a bv for a complete overview of the tax rules.

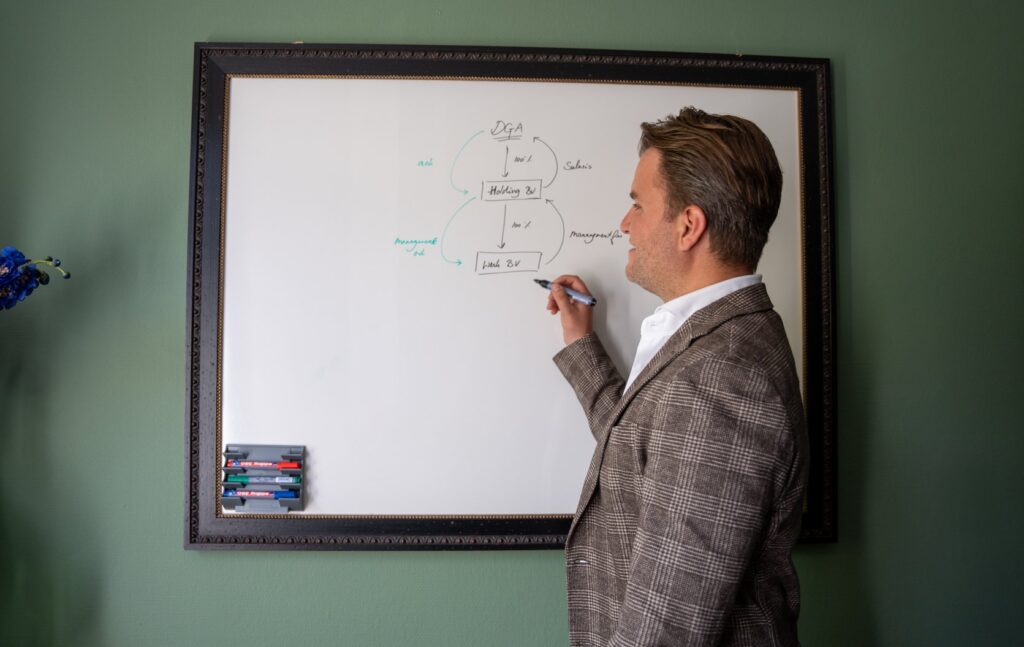

The holding company, like the bv, is a partnership. There are many misconceptions about different types of bv's. A holding bv, a work bv, management bv, savings bv, etc. These are all bv's, it is only the objective that is different. The difference between a bv and the holding company is that the holding company is a passive holder of shares in a bv. A holding company is used as a vehicle to hang underlying bv's under. This offers legal and tax advantages. By housing the valuable assets in the holding bv, they are shielded from bankruptcy. The real business is always done from the work bv, of which the holding company holds the shares. The work bv therefore also houses the risks.

Do you have questions about the bv or other forms of enterprise? We have the necessary knowledge and experience in setting up a bv, holding company structures, directors' liability and more. Then feel free to contact us without any obligation.

Do you want to start today?

Which is the best choice? Employ a bookkeeper or outsource it to an accounting firm? Read more about it here.

What is the role of a shareholders' agreement and why should you include it when setting up a bv? Read more about it here.

Read here what you need to consider when setting up a bv with a foreign shareholder.

Belastingadviseur Eindhoven is onderdeel van Adviesgroep Eindhoven. De one-stop-shop voor ondernemers, particulieren en expats.

Om de beste ervaringen te bieden, gebruiken wij technologieën zoals cookies om informatie over je apparaat op te slaan en/of te raadplegen. Door in te stemmen met deze technologieën kunnen wij gegevens zoals surfgedrag of unieke ID's op deze site verwerken. Als je geen toestemming geeft of uw toestemming intrekt, kan dit een nadelige invloed hebben op bepaalde functies en mogelijkheden.